A powerful DTI can also be improve your financing options, possibly minimizing interest rates and you may expanding acceptance opportunity. You’ll however you want at least a ten% put (as well as places below 20% Lender’s Mortgage Insurance (LMI) can be applied). Expertise your own credit electricity is the foundation of to find an excellent home, refinancing, or considered a huge pick. Borrowing from the bank power — sometimes named borrowing skill or financing qualification — is the limit loan amount a lender will agree centered on the money you owe.

Try a main and you may Desire Financing a good choice to you?

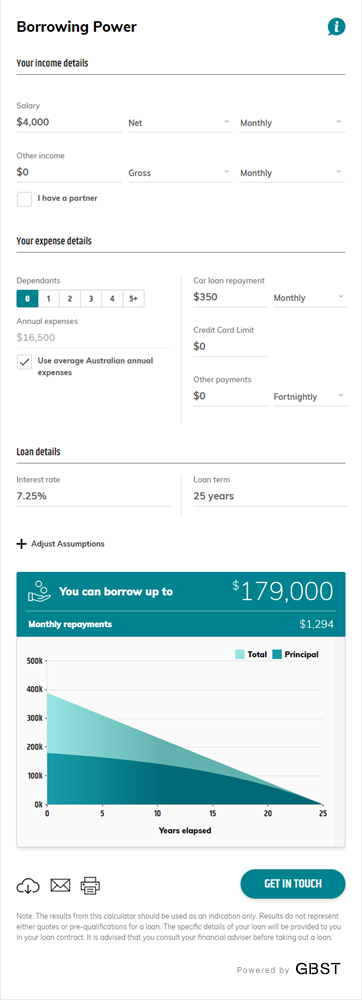

Mention your house mortgage options if you are searching to find, refinance or invest in assets and acquire competitive rates due to Smart. Yes, the pace you are offered features a huge influence on simply how much you could use – and also a small rates transform can impact your loan amount by thousands of dollars. This shows one actually popular bills for example a car loan can be noticeably slow down the matter you’re also able to borrow to have property. Here are a couple from situations showing how also seemingly small change produces a real distinction.

Why sign up for conditional pre-acceptance?

It functions such as a credit card, enabling you to acquire what you need, as it’s needed.

Explore all of our totally free HELOC calculator to see your own possible borrowing electricity. Tiimely House gets earnings away from Tiimely Own fund and you may, in which customers apply for a loan for the help of an excellent Tiimely Household broker, from finance compensated with panel loan providers. More information concerning the borrowing characteristics provided with Tiimely House is for sale in the fresh Tiimely Family Borrowing from the bank Publication (PDF) and you may Tiimely Household Representative Credit Book (PDF).

We do not guarantee the reliability or applicability ones data to the individual issues. The outcomes provided commonly an offer from credit otherwise a good commitment to lend and don’t mirror all available loan apps. Degree, rates of interest, and repayments try at the mercy of transform when and certainly will will vary in line with the time of the application, their borrowing reputation, and you can private things.

I encourage looking to independent financial, income tax and legal advice to check how suggestions considering aligns together with your personal things. We’lso are in control lenders, therefore we determine their borrowing from the bank electricity by using the highest of your own projected expenses along with your HEM (Family Expense Measure – an Australian mediocre expense benchmark). The support to purchase System is an additional choice, allowing very first home buyers to purchase a property that have a deposit as little as 2%.

The us government possess element of your property if you do not pay your loan, you simply use what you are able pay for from the financial. Which doesn’t personally boost your credit limit, but by removing the loan count you need, it lets you pay for a far more costly property than you might otherwise. The 5% Deposit Plan lets very first-date consumers purchase a property having a deposit lower than 20% without paying LMI, an extra prices that will include thousands of dollars to your can cost you.

Make it possible to Get common guarantee plan so you can release with a few playing lenders

Sure, which have an excellent guarantor on your home loan you are going to enables you to use more money to find a property. Towards the top of this type of, extremely states and you can territories give you the Earliest Resident Give, gives your a lump sum payment to help with the deposit otherwise remove exactly how much you will want to obtain. This can strengthen your loan application and replace your borrowing from the bank strength. For many who’re also thinking of making an application for a home loan, understanding how far you’re allowed to borrow is just one of one’s basic tips simply take. All of our borrowing electricity calculator makes it possible to score a sense of extent you may be accepted for.

Mortgage Conditions You should know Before applying

As we wear’t security all the team otherwise economic equipment in the business, i strive to express an array of now offers and you will objective article point of views. Either a loan provider will let you borrow far more than your be you might easily repay. Occasionally, a great lender’s estimate may be to the reduced top, and you’ll be upset by restrict count open to you.

Consult with a mortgage representative otherwise bank to possess customized pre-approval also to compare loan points. A guideline would be the fact your full month-to-month mortgage payment and you may present month-to-month debt burden were only about thirty six%-43% of your own disgusting monthly money. Remember that their mortgage payment includes your residence taxes, insurance policies and, if the applicable, mortgage insurance policies and/otherwise month-to-month HOA dues.